Hello, welcome to my Nordic Funder Review.

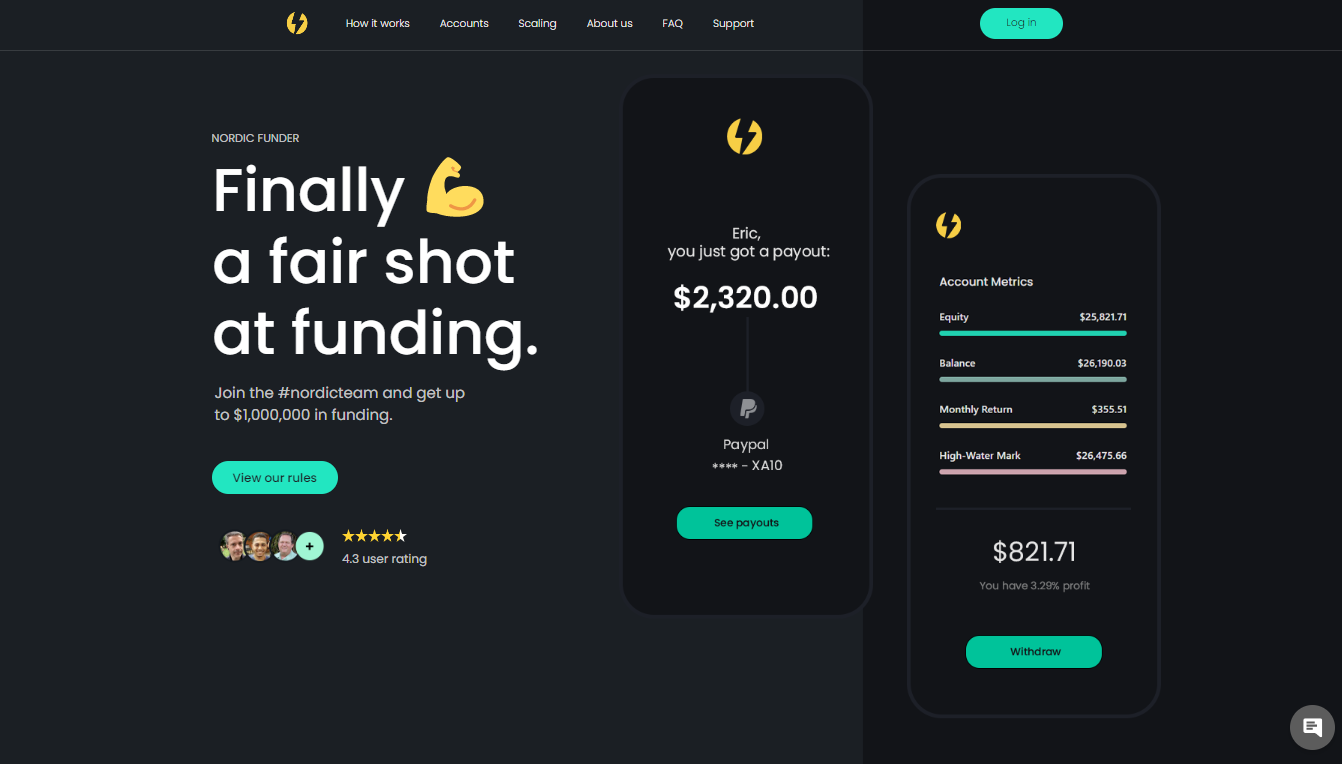

Nordic Funder is on a mission to help you build your financial future by joining their funded account program.

However, it’s worth your time to reach out and learn more about the program before you can try it with your investment.

For this reason, I’ve simplified the entire work for you by providing you with a detailed review of Nordic Funder.

And by reading this review, you’ll capture everything you need to know about the Nordic funder.

Taking that in mind, let’s get started….

Summary of Nordic Funder Review

Product Name: Nordic Funder

Product Type: Proprietary Firm

Registration Fee: Starts from $250, which depends on the account size you choose

Official Site: https://nordicfunder.com/

Program Founder: Chris Tubby

Overall Rating: 7/10

My Recommendation: Yes, but Not for everyone

Nordic Funder Review – Overview

In recent days, there have been an increasing number of prop firms in the forex market, each claiming to be the best.

For this reason, it’s worth your time to research and choose the best prop firm you can trust with your investment.

For instance, Nordic Funder is a proprietary firm that claims to be the best builder of your financial future.

After joining the prop firm, you’ll get the opportunity to enjoy their funded trading platform, which allows you to make profits.

The platform has more than seventy forex pairs, cryptocurrency, indices, gold, and silver.

In addition, the platform uses the Meta Trader 4 platform, with their trusted broker being the Scandinavian Capital Markets available in the country.

But before joining their funded account program, you must pass their one-stage assessment process.

In the assessment process, you must choose your preferred account sizes from the available accounts.

The platform has up to three accounts to choose including; a $25,000 account, a $50,000 account, and a $100,000 account.

After passing the assessment, you’ll be awarded a funded account and begin making profits to achieve your financial goals.

The prop firm offers a profit share of 50% to traders in their platform as their default percentage.

You’re, however, allowed to increase this profit share to the maximum percentage of 90%, which requires you to pay some extra fee.

Pros Of Nordic Funder

- Accepts copy trading and trading of EAs.

- Accepts trading of scripts and indicators.

- Does not set any trading days for traders

- Offers a scaling plan of up to $1000000 account balance.

- Offers a profit share of up to 90%.

Cons Of Nordic Funder

- Contains extra fees.

- Not a suitable option for beginners.

- Doesn’t offer stock trading.

- Doesn’t display the information and details about the owner.

Nordic Funder Customer Results

If you are wondering if Nordic Funder clients are getting any favorable results, here are some recent Nordic Funder proof of payouts.

From July 3-7, there was a total payout of $105,608, while in the below screenshot, you’ll see that from July 10-14, there was a total payout of $125,108 with the highest payout being $56,054.

These are some solid numbers and it’s good to see that members are getting real results with trading on the Nordic Funder platform

Who Should Sign Up with Nordic Funder?

Nordic Funder targets to work with highly qualified traders who can meet their trading conditions.

As a prop firm, they aim to work with highly profitable traders who can reach their profit target to build a financial future.

For this reason, joining this prop firm will only benefit you if you can meet their trading conditions and standards.

In addition, you must be able to pay for the fees set in the platform.

You’ll only trade comfortably in the platform if you pay the extra fee to unlock the numerous restrictions in the default settings.

Also Read: FX2 Funding Review

What Is Nordic Funder?

Nordic Funder is a proprietary trading platform that offers traders a funded account to trade in the forex market.

The prop firm was launched in 2021, headquartered at the Scandinavian Capital Markets in Sweden.

Nordic Funder was declared an independent prop firm the following year, where the company had a community, brand, and voice.

The prop firm is based in Sweden, offering the citizens of the country the opportunity to trade in the forex market.

The prop firm accepts traders from different countries from all parts of the world.

Also, the program offers you a funded account after passing the assessment process.

The profit share you’ll get from trading in the prop firm depends more on your performance in the forex market.

The program excludes itself from being a financial services provider where you can borrow funds to trade in the market.

For this reason, the company experts all their traders and anyone who wants to use their funds to join their platform.

In their platform, you must pass their evaluation process before qualifying for your funded account.

All their accounts in the platform are payable, with their prices set according to the account sizes.

How Does Nordic Funder Work?

Nordic Funder allows you to become their prop trader by passing through their evaluation stage.

Note that the program doesn’t allow you to do your assessment stage using another broker or hire any professional trader to do it for you.

The prop firm uses the assessment process to ensure they trade with highly qualified traders in the market.

The prop firm only has a one-stage assessment for you to get their funded account.

Here are the steps on how the program works:

Choose Account Size

To start trading on the platform, you’ll begin by choosing your preferred account size from the available accounts in the program.

Nordic Funder Prop firm has three different account sizes: a $25,000 account, a $50,000 account, and a $100,000 account.

After choosing your preferred account size, you must pay the price tag to start your assessment stage.

Choose Your Leverage

After completing your payment, you’ll then proceed to choose your leverage.

By default, the leverage for all the available accounts in the program is set at 10:1.

However, the program allows you to choose your preferred leverage, enabling you to double the leverage for your chosen account.

The highest leverage you can upgrade in the platform is 1:2, which will result in greater buying power in the market.

For this reason, you’ll have a maximum exposure allowance while trading with the platform.

Note that when you choose to increase your leverage, your fee will increase by 25%, as it comes with a greater risk for the company’s capital.

For instance, if your fee is 250 dollars and you buy a $25,000 account size, you’ll be charged an extra $62.50.

Visit Nordic Funder Official Website For More Info >>

Choose Your Performance Fee

The program sets a default profit share of 50% for every trader who trades with the funded program of the company.

This means you’ll get 50% of the profits in your funded account when trading in the market.

The company allows you to increase your profit share to 70% or even go up to 90%.

However, the increment of the profit share comes with an additional fee you must pay before you begin your assessment stage.

To get a profit share of 70%, you’ll have to pay 10% of the assessment fee, while for a 90% profit share, you’ll pay 20%.

For instance, if you trade with a $25,000 account, you’ll have to pay an extra $25 to increase your profit share to 70%.

Eliminate The Mandatory Stop Loss

The prop firm sets a mandatory stop loss for all orders in the platform but allows you to disable the requirement.

But when you remove the stop loss, you will be trading on risk, and the prop firm charges you an additional 10% of your assessment fee.

Disable No Weekend Positions

In this section, the prop firm sets a default weekend position to be closed before 20:30 GMT.

However, you can default to this setting by paying 10% of your assessment fee.

Start the Assessment Process

Here are what is contained in their assessment stage:

- 10% profit target, which you must make for you to qualify for the funded account.

- A minimum trailing loss of 10%, which you must respect when trading at this stage.

- The maximum daily loss in this stage is set at 5%, which you must respect to ensure your equity does not go below 5%.

- There is no time limit for trading in this stage, which is only one stage with no recurring fee and no other hidden fees.

- You can trade proportional lot sizes between your account size and the leverage.

- The company allows copy trading, trading indicators, script trading, and trading EAs.

Nordic Funder Funded Account

You’ll be awarded a funded account when you complete the assessment period successfully.

In the funded account, you’ll begin earning a profit share from your trading profits.

The default profit share percentage is 50/50, you get 50%, while the platform takes 50%.

However, you can increase your profit share by paying 10% of your assessment fee.

The platform allows you to increase your profit share to up to a maximum percentage of 90% which will cost you an extra fee of 20%.

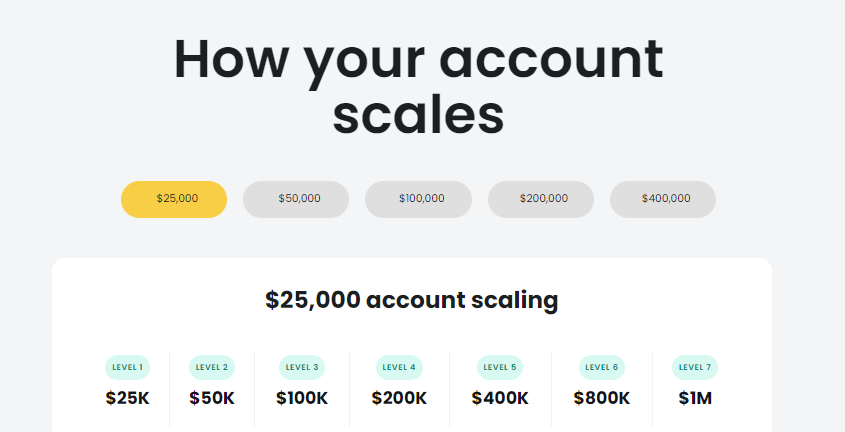

If you’re highly profitable, you can qualify for a scaling plan to increase your account balance to a maximum value of $1,000,000.

No time limit or profit target is set in the funded account, allowing trade at your own speed.

However, you must respect the maximum trailing loss of 10% and maximum daily loss of 5%.

In addition, you are free to copy trade, trade news, EAs, and trade overnights and weekends.

What Is the Nordic Funder Scaling Plan?

Nordic Funder prop firm also provides traders with a scaling plan to increase their account size to a maximum balance of $1,000,000.

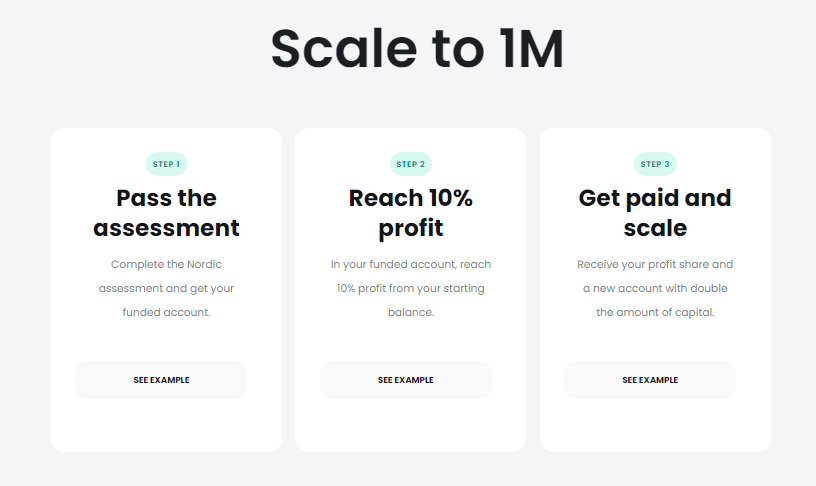

For you to qualify for the scaling plan, you must pass through the following steps;

Step one: Passing the Assessment

You must complete the Nordic Funder assessment stage and get a funded account on the platform.

Step two: Reach a profit target of 10%.

After getting your funded account, you must reach a profit target of 10% of your starting balance.

Step three: Get paid and Scale your account

You will qualify for the scaling plan when you meet the two conditions in the platform.

You will, therefore, receive your profit share and have your capital doubled in the account.

This means that if you use the $25,000 account, it will increase to $50,000 after the first scaling.

The second scaling will increase the account to $100,000 and up to the maximum balance of $1,000,000.

Visit the Nordic Funder Official Site

What Are The Trading Instruments Used In Nordic Funder?

In the Nordic Funder Trading Platform, you are allowed to trade more than 70 currency pairs.

You can also trade precious metals such as silver and gold.

In addition, the platform allows you to trade West Texas crude oil, cryptocurrencies, and indices.

However, the Nordic Funder does not offer stock trading.

For this reason, if you love trading forex, you will be disadvantaged as you will not get the opportunity to trade it on the platform.

What is the broker used in the Nordic Funder?

Nordic Funder uses a Swedish broker because the company is based in the country.

The Swedish broker, in this case, is the Scandinavian Capital Markets, a pure ECN/STP broker from Stockholm, Sweden.

Nordic Funder currently uses the Meta Trader 4 platform for trading.

What Are the Benefits of Joining the Nordic Funder?

- Nordic Funder offers a scaling plan of up to $1,000,000.

After joining it, you’ll stand a chance to qualify for their scaling program to increase your account size.

In the scaling plan, you only need to reach a profit target of 10% to receive the scaling plan.

As such, you’ll have to be more profitable to enjoy their scaling plan services.

- The prop firm offers a profit share of up to 90%

When you start trading with the live-funded account, you will enjoy a profit share of up to 90% in the program.

In addition, the profit share enables you to maximize your profits and achieve your financial goals.

Your profit depends more on your trade speed and the account size you choose to work with.

- The prop firm does not set minimum or maximum trading days for traders.

The Nordic Funder platform does not set any minimum or maximum trading days for traders.

This allows traders to trade at their own speed and get the maximum profits out of their trade.

In addition, you will have more flexible time to continue trading and achieve your financial goals.

- Nordic Funder allows script trading.

Nordic Funding prop firm is unique because it allows you to trade EA and script trading.

In addition, the prop firm allows copy trading and trading of EAs.

Try Nordic Funder >>

What Is The Cost Of Joining The Nordic Funder?

The cost of joining the Nordic Funder account depends on your chosen account size.

Here are the available account sizes with their corresponding fee;

- $25,000 account size that costs a one-time fee of $250.

- $50,000 account size that costs a one-time fee of $400.

- $100,000 account size that costs a one-time fee of $750.

The company promises to refund all the fees after joining the platform and making at least a 10% profit target in your funded account.

On the other hand, the platform charges extra fees on other conditions set in the program, which are optional for traders.

The conditions include the following;

Changing your leverage from the default setting costs you an extra fee of 25% of your assessment fee.

A performance fee determines your profit share and costs you an extra fee of 10% to 20%.

The performance fee depends on the profit share you buy, which varies from 70% to 90% maximum value allowed in the platform.

The remove mandatory stop-loss rule also costs 10% of your assessment fee when changing.

In addition, if you remove the weekend positions from the default settings, you will pay an extra fee of 10%.

However, you can avoid paying the extra fee by restricting your trade to the default settings as provided in the platform.

On the other hand, the Nordic Funder prop firm does not allow traders to have a funded account with another currency.

You’ll, therefore, have to restrict yourself to using US dollars, which is the default currency of the prop firm.

Related Review: City Traders Imperium

Does Nordic Funder Offer A Refund Policy?

The platform promises to refund the assessment fee after getting your funded account.

The fees paid to join it exist are due to two reasons.

The first is to make the traders take the assessment exercise seriously to prevent them from losing money.

The program claims that if the traders don’t take the assessment seriously, they may fund unqualified traders.

The second reason is risk management.

The prop firm claims to face many risks when funding live accounts on the platform.

The set fee in the platform helps the company offset the risk allowing them to deliver real accounts and set real conditions for qualified traders.

For this reason, the payment of the fees is compulsory for anyone who wants to become a Nordic Funder prop trader.

Visit the Nordic Funder Official Site

Is Nordic Funder Prop Firm A Scam?

The Nordic Funder prop firm is NOT a scam.

The prop firm offers traders an opportunity to trade in the forex market through their funded trader account.

Traders can trade up to 70 currency pairs with their funded account, including indices cryptocurrency.

The program, however, expects you to pass their assessment stage before you can get their funded account.

In the funded account, the program expects you to respect their trading rules and reach a profit target of 10% to get their funded account.

For this reason, the program targets to work with only profitable traders who can reach their profit target.

In addition, the program expects you to be hardworking to get significant profits in your account.

Going by the charges included in the Nordic Funder platform, the program is too expensive for beginners.

On the other hand, the profit share offered by the platform for free is relatively low as the prop firm only awards a default profit split of 50%.

Increasing the profit share to 90% costs an extra fee that may not apply to some prop traders.

If you cannot pay the extra fees, you will trade under restrictions made by the default settings in the platform.

The restrictions may make some traders uncomfortable when trading on the platform.

Based on these remakes, the Nordic Funder account is not for everyone; the prop firm is more suitable for experienced traders.

In addition, you must be able to pay for the extra fee set in the platform, which makes it not an option for low-income earners.

If you find this platform unsuitable, there are other cost-effective platforms you might join to start making money online.

My Assessment Of The Nordic Funder

Scaling Opportunities – 8/10

The scaling opportunities offered by the prop firm are excellent compared to other prop firms in the forex market.

If you qualify for the services, you’ll enjoy a scaling plan of up to $1,000,000 on your account balance.

The program requires you to reach a profit target of 10%, which is more realistic for most experienced traders.

Profits Targets – 4/10

The default profit target Nordic Funder prop firm sets is low compared to other prop firms in the forex market.

Most prop firms allow traders to enjoy a profit split of up to 90% without charging any extra fee to traders.

For this reason, the extra fee put on the higher profit targets in the platform makes it less applicable to traders.

Affordability – 3/10

Nordic Funder has many extra charges in its assessment fee, which makes it less affordable to most traders.

Only traders who can raise the charges benefit from the platform, while others trade under restrictions.

Trader Supports – 6/10

The trader support offered in the Nordic funder is average compared to other prop firms in the forex market.

The trader support in the platform is less reliable, with their expert team not always available for traders when they need them.

Tradable Assets – 7/10

Nordic Funder offers a variety of tradable assets, including forex pairs, cryptocurrency, indices, silver, and gold.

Unfortunately, the prop firm does not offer stock trading, which makes the lovers of the instrument not have a chance to trade it.

The platform has more than 70 currency pairs you can trade in their platform.

Trustworthiness – 6/10

The process of trading and operations with the services available on the platform is reliable and friendly.

For this reason, Nordic Funder is a trusted prop firm where you can trade and get your profit share.

In addition, the program has many testimonies of traders who express their satisfaction with its services.

My Overall Rating: 7/10

In general, Nordic Funder is one of the upcoming proprietary firms in the forex market with a reliable trading environment.

The user-friendly platform makes it easy for traders to maximize their trade and earn more profits.

I, therefore, give a rating of 7/10.

What Are People Saying

Here are the reactions of people about Nordic Funder online;

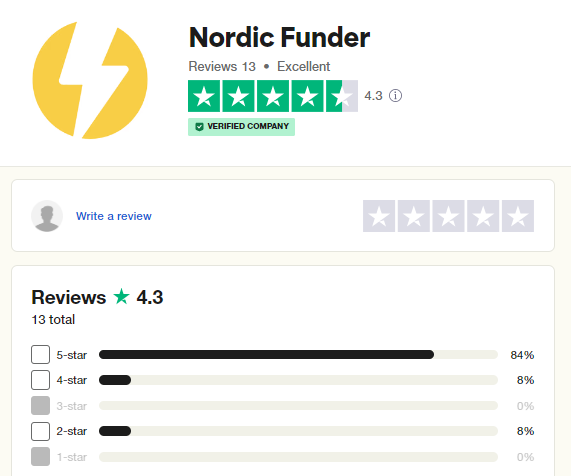

Trustpilot

In the trust pilot, Nordic Funder has an impressive rating of 4.5 which shows its outstanding performance in the market.

The program has the highest number of reviews, rating it five starting in the Trust pilot platform.

Here is how the prop firm has performed in the trust pilot:

The Nordic Funder prop firm has more than 3,000 followers on its Facebook page.

In addition, the company has more than 2,900 likes on its page.

Overall

The Nordic Funder Prop firm is an upcoming prop firm with great expectations for future trade.

Having achieved its brand and community in 2022, the prop firm focuses on improving its services to become one of the best prop firms worldwide.

However, it is Sweden’s largest and most reliable prop firm, allowing Sweden citizens to trade with their own prop firm.

FAQs About Nordic Funder

Can I Have More Than One Funded Trading Account In The Nordic Funder?

Yes, the Nordic Funder allows traders to own multiple trading accounts on the platform.

However, you will have to participate in the assessments for every account you own, irrespective of the total number of accounts you want to launch.

In addition, you can only use multiple accounts in trading different products and strategies, as the platform does not give more than $1,000,000 for one account.

How Long Does Getting a Funded Account In The Nordic Funder Take?

To get to the funded account, you’ll first receive an assessment account after ten minutes of ordering.

When you complete the assessment, you’ll receive your funded account within one hour after verification.

The time you take to complete your assessment depends on your trading speed and profitability.

Can I Hold My Positions Over The Weekends?

Going by the default settings in the platform, you’re not allowed to trade overnights, as the trades are all closed by 21:00 CST.

This means that the program will automatically close any account open at this time, limiting you from trading.

However, the program allows you to change this default setting to trade overnights and during weekends by paying an extra fee of 10%.

How and when Can I Request A Payout From The Nordic Funder?

When you have your funded account, the company requires you to make at least 1% profit to qualify for a payout.

When you meet the condition, the company does not set any time production on when you can request your first payout.

You can, therefore, request a payout from the platform, which is made through Banck transfer, BTC, Paypal, or USSDT.

What Happens If I Don’t Trade For More Than A Month?

If you don’t open your live funding account for more than thirty days, your account will automatically be closed.

This also included failing to modify your account in any positions on consecutive days for over a month.

You must retake the assessment process before getting another funded account when your account is terminated.

Can I Hold the Position Overnight?

The prop firm allows you to hold your positions overnight as you wish when trading.

However, all the trades are always automatically closed by 2100 UTC on Fridays as the platform doesn’t accept weekend trading.

You can only change this default setting and enjoy trading and holding positions over the weekend by paying the required extra fee on the platform.

Thank you for reading my Nordic Funder Review.