I’m happy to invite you to The Trading Capital Review.

In this post, I’ll be shedding light on this proprietary firm and let you know whether it’s a place to seek funding for trading.

Of course, you can visit many platforms to get funding, like Funded Trading Plus, but for this review, let’s find out if The Trading Capital is a suitable platform to add to our list.

Summary Of The Trading Capital

Name Of The Product: The Trading Capital

Type Of Product: Traders Funding Platform

Official Website: https://www.thetradingcapital.com/

Overall Ratings: 7/10

Overview

Looking to kick-start your trading career?

The Trading Capital, a premier proprietary firm, is actively seeking talented prop traders to join its online platform.

With its user-friendly program, The Trading Capital ensures that anyone with a passion for trading has the opportunity to achieve financial success.

Whether you’re looking to gain financial freedom or increase your profits, The Trading Capital is committed to helping you achieve your business goals by providing you with the trading capital of your choice.

With a scaling plan of up to $2,500,000, prop traders can reach their full potential and excel in their trading goals.

But, as with any trading firm, it’s important not to solely rely on their claims.

Keep reading to learn all the details about The Trading Capital and how it can help you reach your trading aspirations.

Related Prop Firm: e8 Funding

The Trading Capital Pros

- Provides Free Evaluation retry

- Achievable profits targets

- 85% profit share

- The scaling plan goes up to $2,500,000

- Tight Spreads on Forex currency pairs

- 120% refundable fee

- Very flexible trading conditions

- Expert Advisors

- Use the regulated FXPRIMUS brokerage

The Trading Capital Cons

- There are few trading instruments

- The Company has no instant Funding Accounts

- Only accepts MT4 Trading Platform

- No trader Dashboard

- Does not have a Free trial

- High Evaluation fees

Who Should Sign Up with The Trading Capital?

If you are passionate about becoming a proprietary trader online, then the Trading Capital firm is looking for you.

The prop firm targets to get people with great talents to trade to achieve financial freedom.

For this reason, you must be more trustworthy, talented, and profitable for you to join the platform.

If you meet these conditions, you’ll find trading on this platform much simpler.

In addition, you should be able to pay the required fee and adhere to the restrictions and rules for trading set in the program.

This will enable you to easily progress in your trading and achieve your business goals as expected.

Who Should Not Sign Up With The Trading Capital?

If you have never imagined becoming a proprietary trader or have no trading skills, then this platform isn’t your option.

I say so because joining the program will not benefit you easily because you may not understand the basic trading concepts.

This also applies to people who are not talented in trading or have never thought of becoming one.

However, this does not mean that you can’t become one of the traders.

The only challenge you will face is that adapting to the trader will take much longer.

You may also fail to pass the evaluation stage and lose the opportunity to become part of their trading team.

What Is the Trading Capital?

The Trading Capital is a proprietary firm started in 2019.

The company is located in the heart of square one, beside the Monroe Towers found in Mississauga, Ontario, Canada.

The offices of the company are located on the fifth floor of 4 Robert Speck Parkway.

In the beginning, Trading Capital was a private prop firm used by close friends and relatives such as family members.

The platform was majorly operated on word of mouth and email as its main advertising and communication methods.

The company became open to more traders worldwide in 2021 when it created its own platform.

They provided access for many traders across the world to their website and were able to trade with an increased number of traders.

The prop firm claims to focus more on providing quality services than quantity.

For this reason, the firm doesn’t dwell on advertising or offer fancy marketing as part of its business.

The company claims to have had slow and steady growth since it launched its website, being able to satisfy more customers online.

The Trading Capital company has its goal set on helping traders with skills and talents in gaining their financial freedom.

To justify their claims, let’s look at how the company works.

Market Leader: The Funded Trader

How Does The Trading Capital Work?

The proprietary firm works by letting you pass through a trading evaluation before becoming a full prop trader.

In the trading evaluation, two steps keep things more simple and easier for traders.

After you meet the set evaluation objectives, it’ll be a proof test to show your selling skills.

The program will then promote you to become part of their proprietary traders and start trading with them to achieve your financial freedom.

The two-evaluation process is named Phase One and Phase Two, with profit targets of 8% for Phase One and 5% for Phase Two.

The maximum daily loss allowed in the evaluation process is up to 6%, with a maximum drawdown of 10 to 12%.

Unlike other platforms, a minimum of ten days is required for the trade in the evaluation stage, which does not require any trading days.

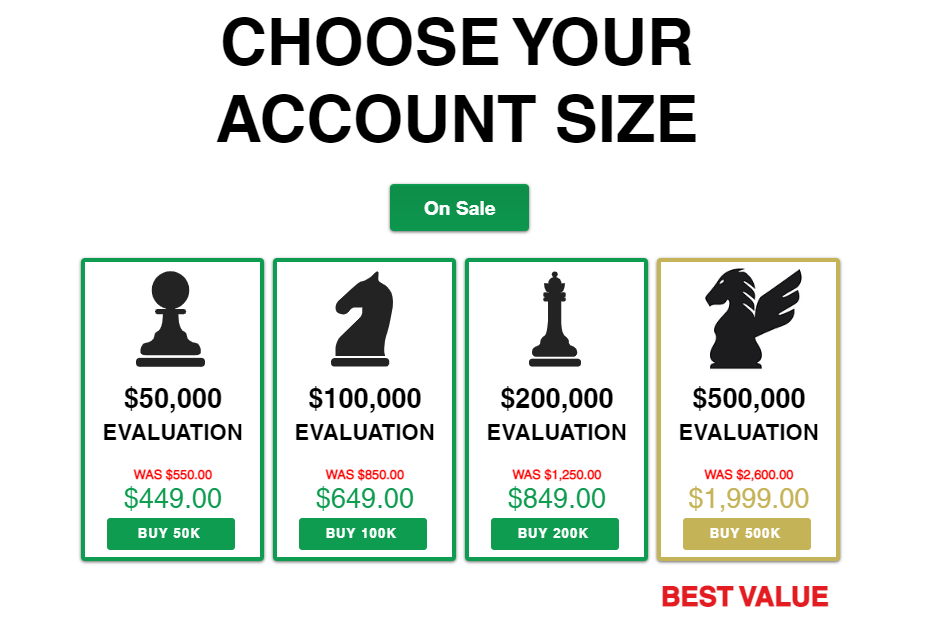

The Trading Capital program provides up to four account sizes ranging from 50k, 100k, 200k and 500k

Even though the prop firm may not be the leader in the market, their trading prices may be considered the lowest.

You’ll only have to choose your preferred evaluation and then proceed to the check-out stage.

In this stage, the program will process your evaluation in not more than 24 hours of business days and send you a notification.

The notification will be sent to the email account that you used to open your PayPal account and has all your required credentials.

Your evaluation process will begin immediately when you place your first trade.

Breakdown Of The Trading Capital Trading Account

Here is how the trading capital account works to ensure you achieve financial freedom.

The evaluations are divided into two phases that require at least ten days to complete.

You’ll be qualified to become a member of the prop traders once you successfully pass your evaluations.

Trading Parameters On The Trading Capital

The Trading Capital prop firm claims to offer you an evaluation with the most flexibility and freedom you will love.

The freedom and flexibility are aimed at giving you the highest chance of success when trading with the platform.

The prop firm claims to be the most acceptable company and very competitive as compared to other proprietary Trading companies.

Despite the claims, there are some restrictions the company puts forward to help it manage its operations with traders.

Here are the new trading restrictions that every prop trader in the Trading Capital firm should know and follow.

-

8% Profit Target

The company sets its profits target at 8% for every trader during the evaluation stage, which it claims to be the best in the industries.

However, traders are allowed to execute any strategy in their trading process to meet the set profit target.

The company will, therefore, accept any strategy you come up with as long as the program can replicate it.

According to the company, achieving this target is much more realistic when you combine it with other parameters available in the platform.

-

12% Maximum Drawdown

The Trading Capital claims to keep it simple for traders to easily pass their evaluation by setting the drawdown at 12%.

Apart from setting its drawdown at 125, the proprietary firm sets its maximum daily loss at 6%.

With a smaller daily loss, the company gives its traders an expanded breathing room to include their strategies in the business.

According to the prop firm, mistakes can happen, which they understand and consider.

They will therefore allow you to correct your mistakes and recover to meet your trading goals.

-

85/15 Profit Split

The company has managed to get many talented traders, which they claim to have made their business grow drastically.

This has made them increase the profit split for customers to 85% as a strategy to let the customers benefit more from their business.

In the beginning, the company set its profit split at 50% in 2019, but as the company grew, it increased the profit split.

According to the company, the higher profit split in the company was achieved by improving their trading conditions.

The company aimed to do everything possible in its capacity to help its proprietary traders succeed in their business.

The higher profit split has also simplified the evaluation for many platform traders and increased their number.

-

Bi-Weekly Withdrawals

Waiting for your first withdrawal for your first profit split may be very interesting, especially when you have a passion for the trade.

The company began by providing a monthly daily split withdrawal before changing it to a weekly withdrawal.

You, therefore, don’t have to wait for a whole month to withdraw your first profit split as the company can access its profits quickly.

The company does not have any minimum withdrawal amount, allowing you to withdraw any amount you want.

-

120% Refund

The Trading Capital prop firm claims to understand what it is to get your refund with your profit split.

The 120% refund is a strategy the prop firm puts forward to make the business sweeter for the traders to succeed in the business.

When you combine the trading parameters and the 120% refund, the company ensures every trader uses it with ease.

-

Scaling Plan Up to $2,500,000.

After joining the Trading Capital Prop Firm, you’ll get the highest capital you need to scale up your business.

So, if you are a well-talented trader, you’ll be able to add more capital to your portfolio to help you achieve your business goals.

The company promises to increase the account size by up to 25% every three months, especially if it makes at least 5% in the given months.

The firm, therefore, expects you to put 15% as your target for every month to enable you to qualify for more capital of up to $2500000.

-

No Restrictions for EAs News and Weekends

The prop firm does not provide any restrictions to traders on EAs, news, and weekends so long as you have a profitable strategy.

You are only allowed to respect the market conditions and adhere to the trading parameters for you to enjoy trading freedom.

The company, therefore, allows you to use EAs, trade via news, use trade copiers, and allow you to hold a trade over the weekend.

This makes trades enjoy trading with the platform combining all the above conditions.

The Trading Capital Features

Here are the features available in the program;

-

Brokers

The preferred broker used by the pro firm is the FXPRIMUS broker.

The company chose the FXPRIMUS broker because of the following reasons;

The broker is more flexible and has tight spreads.

Also, the broker has great execution speed and low commission fees.

In addition, the broker has higher leverage than other online brokers.

The broker is also regulated, allowing the traders to focus more on the strategies they set for their trading activities.

-

The Platforms

The Trading Capital Prop Firm uses the Meta Trader 4 (MT4).

The MT4 platform is among the most popular platforms used in forex trade for most beginners and experienced traders online.

The program has the required tools to conduct the market analysis that is capable of being used in different timeframes and chart types.

The platform also allows you to use order types such as instant, pending, and limit when running automated trading systems.

The program also has plenty of tools used in trading that help you in trading.

-

Instruments

The Trading Capital program allows you to use numerous financial instruments such as precious metals like silver, gold, or platinum in trading.

You can also use forex currency pairs and oil as your instruments when trading on the platform.

Steps for Joining the Trading Capital

Here are the steps for joining the trading Capital program;

Step One: Registration Process

To become a Trading Capital prop firm trader, you’ll first begin by registering on the platform.

The program then takes you through their evaluation test.

Step Two: Evaluation

In the evaluation stage, you’ll first view the objectives of the program effectively.

This lets you know if you can become part of their proprietary traders when you join their platform.

The evaluation stage has two phases, phase one and phase two.

The last step is becoming a prop trader for the company.

After checking on the objectives set for every phase of the evaluation stages, you will then proceed to choose your account size.

Step Three: Choosing Your Account Size

You can choose from up to four account sizes in the program.

The sizes include;

- $50,000 account size, which includes evaluation

- $100,000 account size, which also includes evaluation

- $200,000 account size with evaluation

- $500,000 account sizer with evaluation

From there, you’ll have to pay the price set for your chosen account size and start trading with the platform.

When you successfully begin trading, you’ll be promoted to full prop trader, especially when you pass the evaluation.

What Are the Benefits of Joining the Trading Capital?

- The Prop firm provides you with up to 85% profit share.

When you begin trading with the platform, you will earn the lion’s share of the profits you make.

The company only takes 15% of the profits, leaving the rest for you.

This enables you to easily grow your business and achieve your goals faster.

- Have a higher scaling plan

The company offers you a higher scale plan of up to $2500000.

This provides you with a greater opportunity to set your business target and achieve your goals.

- Provides you with a 120% refundable fee.

When you join the program, you will enjoy a refund fee of the profit split as a way to promote traders on their platform.

This is also a strategy to make trading in the program as suitable as possible for their traders.

What Is the Cost of Joining the Trading Capital?

The cost of joining the Trading Capital prop firm depends on the account size you choose;

Here are the account sizes with their respective process;

- $50000 account size costs $449.00 to buy

- $100000 account size costs $649.00 to buy

- $200000 account size costs $849.00 to buy

- $500000 Account size costs $1999.00 to buy

Is The Trading Capital A Scam?

No. The Trading Capital program is not a scam.

You can join the program and trade with their capital to earn your profit share as set by the company.

After you join the prop firm, you may find that trading in the program isn’t as easy as it sounds.

This is due to the set of restrictions on traders.

Therefore, you’ll develop a strategy to help you overcome the strategies to effectively trade in the program.

For instance, the company expects you to complete the evaluation stage before trading with real money.

In their evaluation stage, there are conditions you’ll have to meet for you to advance to the next level.

The conditions include meeting the profit targets, the drawdown percentage, and the daily loss.

Sometimes, meeting these conditions might be difficult for some people making it difficult to pass the evaluation stage.

So, if you find the program doesn’t suit you, then you will have to look for another cost-effective program to join online.

My Assessment of the Trading Capital

Profits Split – 8/10

The program has an impressive profit split as it allows you to pocket up to 85% of the profit share in the business.

This motivates many traders as it helps them quickly grow their businesses and achieve their goals online.

It is among the proprietary firms with the highest profit share in the trading industry.

Scaling Opportunities – 9/10

The Trading Capital prop firm provides you with the best trading opportunity to help you scale your business.

The prop firm enables you to scale your business with a plan of up to $2,500,000 to easily achieve your business goals.

With the higher scaling plan, the company claims to be the best in scaling your business in the trading industry.

Profits Targets – 7/10

The company has a lower profit target in its evaluation stage and absolutely no target when you become a prop trader.

This strategy enables them to make the evaluation as easy as possible for many traders to pass.

When you are capable of reaching the profit target, the company will easily promote you to become a member of their prop traders.

Affordability – 7/10

The company tries all means possible to make its platform more affordable and flexible for any trader worldwide.

They have numerous strategies put forward to ensure their platform is accessible to many traders who want to join the program.

This includes lowering their entry fee for traders and making their services easily available for everyone.

Trader Support – 8/10

The prop firm also has good customer support for its traders.

The company makes everything in its capacity possible for traders to pass their evaluation and join their trading team.

Their main aim is to see every trader who joins their platform succeed in their business.

Tradable Assets – 7/10

The Trading Capital Prop firm has numerous trading assets for traders who want to trade in any of their trading account sizes.

You will, therefore, not have to worry about the account size you choose when it comes to enjoying their trading assets.

The trading assets in the program are set to help promote the trade in the program and help you grow your business.

Trustworthiness – 8/10

Numerous online testimonies of the Trading Capital prop firm show how legit the company is.

The company is also operating under legal authorities with a valid license from the international bodies that govern the trade.

My Overall Rating – 7/10

I give Trading Capital Prop Firm an overall rating of 7/10 based on its trustworthiness and operations.

The company has a good performance in the market and adheres to the rules and regulations set for the trading firms in the industry.

What Are People Saying

Trust Pilot

The Trading Capital Prop Firm has more than 40 reviews on the Trust Pilot website.

The company achieved a great rating of 4.2/5, which is impressive for a prop firm.

The company has more than 1843 followers, 249 followers, and more than 96 posts on its Instagram page.

They have many positive comments and reviews on the platforms, which shows how impressed most traders are with the platform.

Overall

The Trading Capital company generally has positive ratings and reviews online for most people who visit their platform.

And for that reason, I award it a rating of 4/5 in overall rating.

FAQs About the Trading Capital

What Account Sizes Do The Trading Capital Company Offer?

The Trading Capital company offers up to four account sizes, including $50000, $100000, $200000, and $500000 accounts.

You are therefore provided with up to four options to choose from and join to start trading online.

Each and every account size has its own rules and regulations when you choose, and it becomes easier when you gain more experience.

How Many Experiences Do I Need To Apply For?

Experience is one of the key subjective aspects of trading for everyone who wants to trade money and gain financial freedom.

It determines your confidence level when trading, helps you develop a working trade plan, and is checked during the trader evaluation process.

Regardless of your experience, the company welcomes you to its platform and allows you to start your proprietary trade online.

How Long Does Evaluation Take?

The evaluation stage has two phases, each with its own duration to complete.

Phase one takes four weeks, equivalent to twenty working days, and requires a minimum of ten trading days.

Phase two takes four weeks, equivalent to twenty trading days, with a minimum of ten trading days required for you to become a full prop trader.

Does Trading Capital Company Offer Free Retry?

Yes, Trading Capital allows a one-free retry despite making their evaluation incredibly fair to all traders.

The free retry is provided if you have not violated any trading parameter and your account is in a positive balance or neutral.

You should meet all the conditions at the end of your evaluation period before claiming the free retry service.

What Platform And Broker Do Trading Capital Program Use?

The proprietary firm operates on the MT4 platform and uses FXPRIMUS as its chosen seller.

Trading Capital company claims to have preferred using the FXPRIMUS MT4 seller because of its good execution speed and flexibility.

The program claims that the broker is more reliable, which helps in making evaluation easier for traders.

Do I Have To Pay For My Losses?

When you are a Trading Capital proprietary firm member, you will absolutely not pay for any loss you make.

During the evaluation process, the losses are on the demo account and, therefore, do not require you to pay anything.

When you advance into the prop trade, you will not be liable for any loss in your trading time.

Thank you for reading The Trading Capital Review.

Feel free to leave a comment in the section below.